The D2C ecosystem in the country has evolved to a point where almost everybody, quantitatively (and perhaps qualitatively) can agree on what it takes to build a successful D2C business. There is a plethora of models, metrics, and gyaan about the seemingly “right” way to build a D2C business. The reality is that most advice, including mine, is hearsay and often lost in translation. Experimental Advisory, in its premier post, attempts to declutter the jargon, and provide a clearer perspective on D2C businesses in India. Here’s a humble jab, albeit an experimental one, on of the fastest growing and most exciting sectors in India.

Note: There are multiple hypotheses listed in this primer. These hypotheses represent learnings, mental models, and frameworks that may or may not apply in any given condition. Reader discretion for such implicit content is advised. (#iykyk)

Index

The Indian Consumption Narrative

D2C: The Basics

Metrics Matrix

E-merge-ing trends

Fin (ish?)

The Indian Consumption Narrative

The Indian consumption narrative is at its inflection point. The onset of the Covid-19 pandemic in severely distorted consumer spending patterns for months, resulting in a steep GMV downturn, and reduced spending propensity on aspirational consumption.

Print Statement (“False”)Aspirational consumption is relative to economic propensity. It doesn’t die out. Unless, of course, you’re out there purchasing millions of dollars worth of Ether Rocks. The Indian consumption narrative is heavily influenced by millennial discretionary spending. Millennials (born between 1981 and 1996) represent roughly 50% of the workforce 🤯

Source: Deloitte 2021 Millennial and Gen Z Survey

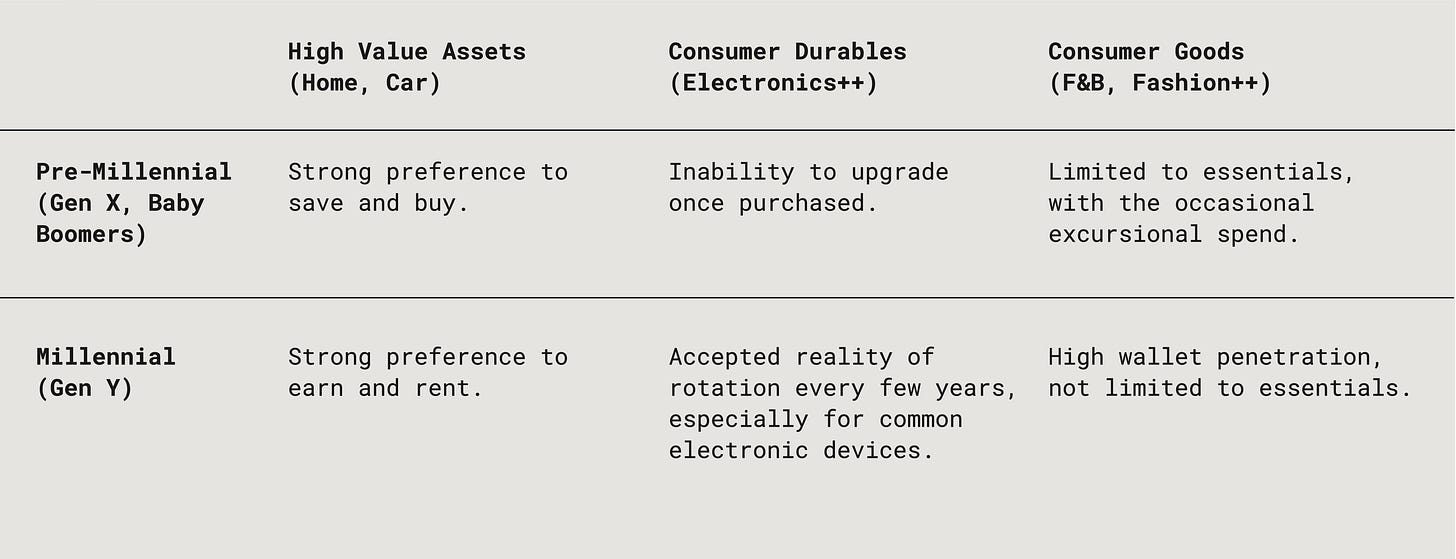

Millennials spend very differently from their parents or the previous generations (Boomers or Gen X). Almost every cost header shows different priorities:

But discretionary spending, at least a good fraction of it (20-30%) can’t be quantitatively explained. There’s a lot more to the true spending habit and could be explained by the following:

Gush of Liquidity and Revenge Shopping

Microeconomics and emotional leverage can explain this trait. Inadvertent savings (commute, food, entertainment) have contributed to a gush of liquidity for the working professional. The savings come as a pleasant surprise, but the surprise itself doesn’t have an established behavior attached to it….yet. Thus, the surprise additional income converts to random Amazon binges that brands (mistakenly) count for repeat customers.

The Great Resignation (TGR)

TGR was/is a global phenomenon of skilled workers switching/quitting their jobs to move on to different industries. A study commissioned by Amazon India in September 2021 revealed that nearly 51 % of job-seeking adults were looking for opportunities in industries where they had no or little experience. Around 68 % were looking to switch industries.

*Hypothesis: If there is liquidity and job security isn’t a concern, then:Comfort + Experience (in the short run) > Safety + Boredom (in the long run)

Inflection Point* 🤝 Venture Capital

Recall: The Indian consumption narrative is at its inflection point: meaning a point in time significant enough to cause continued growth and sustained momentum. The inflection point in D2C comes at the back of momentum gathered over the past 2 years. It started with the “Internet-first” brand wave in 2016-2018, long before D2C became a buzzword. Back in 2017, Internet businesses used to pride themselves on being “disruptive”, “different”, “high-margin” and hence “scalable”, and to be fair, some were but most weren’t. Every major consumer category (F&B, Personal Care, Electronics, Fashion) arguably has one or more winners that emerged between 2016-2018. That’s roughly a 4-6 year gestation period that may shorten over time.

*No relation to Inflection Point Ventures (IPV)

D2C: The Basics

Definition. परिभाषा.

A Direct-To-Consumer business can be defined as a business that manufactures, ships, and sells its own products directly to consumers without the inclusion of any middlemen (Yes, Amazon is a middleman, so is Flipkart, Rakesh the distributor, or your cousin Ramesh) through its own native sales channel.

Let’s break this down sentence-by-sentence, a Direct-To-Consumer business can be defined as a business that:

Manufactures, ships, and sells its own products: This sentence by itself should clarify that a D2C business only deals with its own products and does not aggregate other brands (Exception: co-branding, bundling, etc.)

Without the inclusion of middlemen: It wouldn’t be called Direct-To-Consumer if the product didn’t go…directly to the consumer, yeah?

Through its own native sales channel: Website(s).

*Hypothesis: Manufacture » Advertise » Earn $$ is futile unless you:Build » Analyze » Sell

The Ideal Setup:

The ideal D2C setup is one that accounts for making mistakes but creates the freedom to evolve and pivot quickly:

What makes D2C exciting, disruptive, and scalable (for some):

Ownership

Data: We’ve all read those Buzzfeed articles claiming how “Data is the new Oil” and we’ve all thought, “True” and moved on. That being said, data isn’t really a competitive advantage anymore as much as it is a necessity to possess. For most brands, the opportunity cost of not owning customer data is extremely high. Most businesses are fighting for the same crawl space, the same doom scroll individual, with limited paying propensity per day ($ spent/day cannot be infinite on a recurring basis, unless of course, you own Ether Rocks). Owning intricate levels of data allows businesses to add to an existing marketing strategy, pivot to a different product line, revamp existing packaging, etc. The possibilities are endless. FAANG companies have championed user-data.

Brand Identity: The equivalent of window shopping for the online customer, where they buy what they see, through their screen. Given the lack of middlemen in the selling journey, brand identity remains in control of the manufacturer. Losing brand identity is a costly affair, and at scale, the problem only worsens. (Remember the GAP fiasco?)

Time To Market

Time to Market refers to how quickly and efficiently a business is able to launch its products in the market. Time to market is critical when you consider how competitive every sub-category is turning out to be. The odds of success for a true differentiated product offering is neutralized if time to market is slow. Going D2C allows businesses to bypass this barrier to entry in the short run and scale aggressively in the long run.

Positive Unit Economics

Positive unit economics is non-negotiable. For D2C brands to succeed, they have to command strong margins on every product sold. In theory, going D2C means retaining more per product sold. In reality, there is a trade-off. Margins that are saved by going D2C (i.e. not through traditional distributors/online marketplaces) quickly dissipate under marketing costs (brand and non-brand expenses). D2C necessitates strong gross margins, that hopefully only improve over time and at scale.

Leveraging Personalization. Hype, and FOMO.

Given the rise of consumerism in India, the budget-friendly consumer earns more disposable income, once the surprise savings kick in, the choices per product consumed evolve disproportionately. Recall how Experience + Comfort (in the short run) > Safety + Boredom (in the long run). D2C businesses hold the power to not only create differentiated products but also potentially hold on to the biggest retention cheat code of all time: Personalization, Hype, and FOMO. A great example is how nothing launched ear(1) launched in India:

✅ Seemingly Unique product.

✅ Launched through exclusive sales channels.

✅ Launched only in batches.

Metrics Matrix

If you’re looking to be venture-backed, chances are you’ve already gone through a *rapid fire* line of questioning and have been asked for an insurmountable amount of data, pictured through an all-encompassing MIS that magically contains everything from Gross Margin, Net Margin, RTO, AOV, CAC, LTV, ROAS, Retention rates, CM1, CM2, CM3, CM98768, Property Papers, Legal Will, Will to live, Distribution split, runway, burn…the list is quite literally endless.

How do you escape?Some things in life don’t qualify an escape. They require hacks.

When asked to choose between the Red Pill or the Blue Pill, neither did Neo (aka Keanu Reeves) remain dormant nor did he try to escape. He chose to learn a potentially unsettling and life-changing truth. The hack to the metrics dilemma is choosing between the Red Pill and the Blue Pill. Both have their own set of implications, and their own well-trodden paths. The question is, which one do you choose?

Red Pill

Best suited course of action for businesses looking to scale aggressively and raise external capital. Rome wasn’t built in a day, but successful 100Cr businesses have come up in a (record) 3-year time horizon. The course of action under the Red Pill is to go beyond the truth and deeper into the rabbit hole of metrics that define your business. Consider them as “Moat-worthy” metrics, those that are unique to your business, and will perhaps never be replicated by a competitor, close or distant. The Red Pill mentality supports hacking into growth at scale and calls for a manic-obsession into metrics that are difficult to track or calculate. Fortunately, a D2C-first business gives you access and ownership of 1st party customer data, the value of which is priceless.

For example: A personal care startup receives multiple orders from State X for its Product Y. Product Y doesn’t sell anywhere else but State X. Red Pill mentality is to go beyond into understanding every inch of data node that surrounds this customer behavior. Ask: Why State X? Why Product Y? Time of purchase. Copywriting trigger words. Drop-offs. Order quantity. Session Time. Referrals. Repeat order. Conversion rate…the list is endless, but the chaos has order to it. After studying this data, the right businesses work to optimize this behavior: Recreate performance marketing campaigns and add a warehouse/buy/rent space in State X.

Blue Pill

Best suited course of action for those who intend to create bootstrapped, profitable consumer businesses. The Blue Pill mentality signifies a state of ignorance, a continuity of the current state of life, not necessarily harmful, but not exclusively beneficial. A fundamental non-reliance on external capital, combined with a sustainable growth mindset account for dominant conditions that create a Blue Pill setting. Think of it as Noise-Canceling headphones in the presence of hypervigilant, unsustainable growth, where businesses that have cracked the code don’t need to reinvent the wheel.

“Unfortunately no one can be told what the Matrix is. You have to see it for yourself” - Morpheus

Understanding the Matrix (and Surviving)

OK. Regardless of whether you pick the Red Pill or the Blue Pill, there are a few basic metrics that every D2C business owner should know and track.

Entering the Matrix (and Thriving)

A breakdown of categories and their relative performance against important indicators:

E-merge-ing Trends

D2C, perhaps, is one of the most exciting and investable segments in the early-stage (Pre-Seed/Seed) startup ecosystem. There continues to be a general approval of potentially high-growth consumer startups both from investors but more importantly from consumers. The combination of liquidity, resignation bias, heightened consumerism, reality TV (Thank you Shark Tank!) all of it uniquely manifests the configuration of the current ecosystem and where it could be headed. Here are a few trends worth looking out for:

House of Brands aka Roll up aka Thrasio

Continued Consolidation: M&A has made a comeback and is one of the hottest trends in the consumer ecosystem. Its emergence, however, is not surprising. Key players, both legacy and new-age, are seeking strategic purchases and alliances to drive competitive advantages. A new exit alternative gives renewed confidence to existing and prospective investors.

The Thrasio model is quite simple and is a testament to India’s promising consumption narrative. Acquire profitable companies at a valuation of 2-3x EBITDA paid in sporadic, deferred payments instead of all-cash, upfront (exceptions may exist).

Revenue-Based Financing (RBF)

RBF is a form of debt financing, designed to finance working capital expenses for businesses based on their monthly earnings.

Access to capital completely or majorly dependent on online earnings.

Interest rates on principal can range from 14-25%, with short or long repayment periods.

*Hypothesis: Access Capital --> Show Rotation --> Scale, only if:The business supports positive unit economics.

Retail 4.0: The Online + Offline Era

The convergence of Retail channels and collective evolution of their capabilities via tech-enabled collaborations will define the Retail 4.0 evolution in India. For D2C startups, Retail 4.0 may seem counterintuitive, unnecessary, and unscalable. The hard truth is, India is over-retailed (10% of GDP) and that most D2C businesses have a ceiling to how much they can earn per native channel. For most businesses, it’s not a question of if, but a question of when that ceiling with come. Retail 4.0, at least on paper, solves the ceiling conundrum.

Fin(ish?)

The beauty of D2C lies in unlocking entrepreneurial capability for collective wellbeing. In many waves, the success of D2C is a testament to India being truly Atmanirbhar, in its pursuit of attaining global economic success.

We hope you enjoyed consuming our content, as much as we enjoyed creating it. You have successfully experienced our Experimental Lab! 🧪